Among the most frequent mistakes you may make when receiving an offer letter or a salary slip is determining whether you are being paid gratuity on top of your CTC or on your monthly pay.

I can recall the same confusion that I experienced at the beginning of my career. That is what the offer letter stated CTC was; however, when I received my first salary, the amount was significantly lower. That is when I learned, you have to know CTC and gratuity, otherwise you do not know how much money you are likely to make at home.

Simple, detailed, in this blog I am going to explain to you how the gratuity fits in your CTC, how it is calculated, and even in which cases it is ever deducted from your salary. At the end, you will be in a position to read your salary slip and know what you are actually getting.

What is CTC (Cost to Company)?

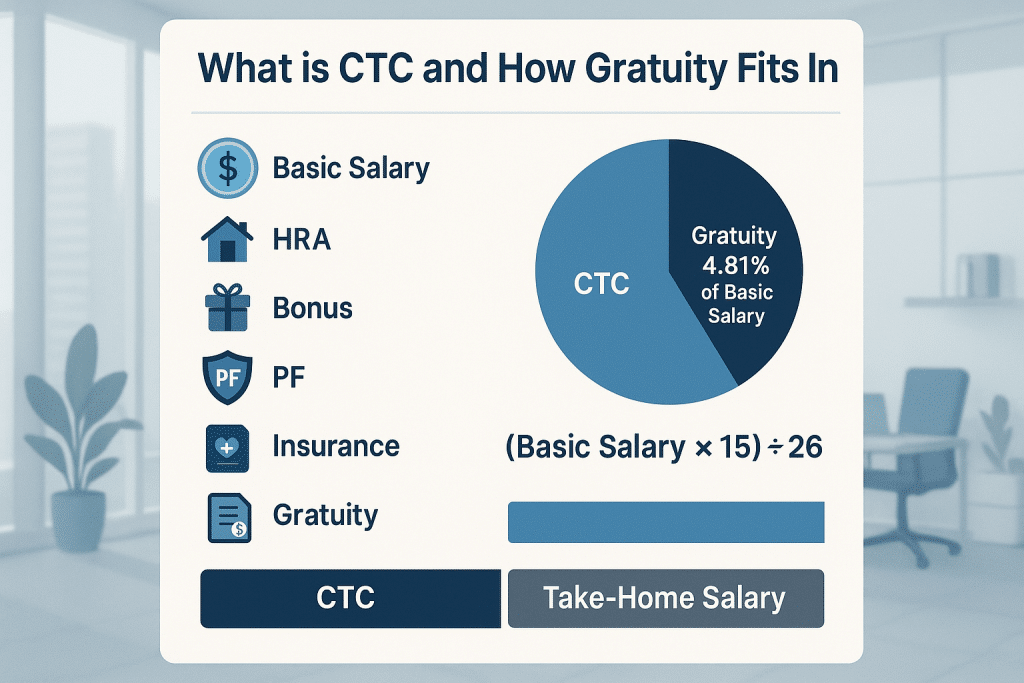

The Cost to Company is actually the literal meaning of CTC, which entails the amount of money a company spends on you as an employee in a year.

It is not only your pay back home, but it is all the rupees that the company is using to keep you employed, e.g.:

- Basic salary

- House Rent Allowance (HRA)

- Conveyance allowance or traveling allowance.

- Medical and special allowances

- Bonus or incentives

- Provident Fund (PF) Contribution.

- Gratuity contribution

- Insurance and other benefits.

Is Gratuity Part of CTC?

Yes, gratuity is considered to be your CTC – but not your monthly salary.

Let me explain clearly.

In situations where the companies draft an offer letter, they will list all the costs that they will incur on you, with the future gratuity liability that they will owe you in case you remain in their employ for at least 5 years.

Therefore, the gratuity element is added to the overall CTC so that the latter can be taken into consideration as an account.

This, however, does not imply that it pays the company every month to deduct gratuity from your salary. Instead, they record an approximation (typically 4.81% of your basic pay) towards you as a liability on their books for your gratuity. You can use our free gratuity calculator for exact gratuity calculations.

How Much (%) of Salary is Allocated for Gratuity?

Now let’s talk numbers.

The amount given will generally be the gratuity contribution of 4.81 percent of your basic salary.

This is by the official formula of gratuity calculation:

Gratuity = ( Basic Salary×15 ) / 26

Where:

- 15 days = 15days of basic pay based on each year of service.

- 26 = Number of working hours in one hour.

Deduction from Salary – Myths vs Reality

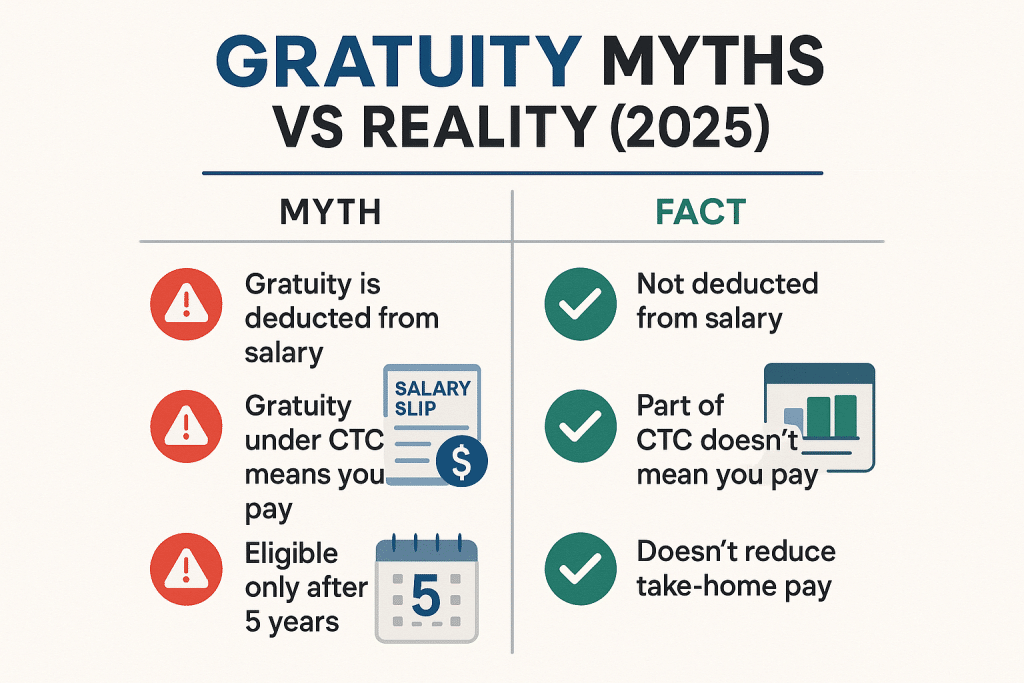

The largest misunderstanding among the employees is that gratuity is subtracted from their monthly salary. That’s not true.

We shall demystify the myths and facts.

Myth 1: “Gratuity is deducted from my salary every month.”

The Fact: Gratuity is not taken away from your salary. It is a burden on the employer, but not on you.

You do not pay anything to be pleased; it is counted in the books of your employer.

Myth 2: “If gratuity is part of CTC, I’m already paying for it.”

Fact: You’re not paying anything. Including gratuity in CTC doesn’t reduce your pay — it just shows the total cost to the company, including what they’ll owe you in the future.

Myth 3: “I’ll get gratuity even if I leave before 5 years.”

Fact: According to the UAE Labor Law, you can receive gratuity if you leave before 5 years, but your gratuity will be reduced, and it will not give you many benefits.

Myth 4: “If gratuity is part of CTC, my take-home salary decreases.”

Fact: Not really. Your salary home is dependent on such monthly elements as basic, HRA, and allowances. Gratuity has no direct impact on your in-hand compensation, but it only makes the perceived CTC lower as you establish what you get on an actual basis, monthly.

How to Read Your Offer Letter / Salary Slip

In case you want to understand whether gratuity is included in your CTC, never forget to look up your offer letter or CTC breakup sheet.

Look for terms like:

- Gratuity (according to Payment of Gratuity Act, 1972) -4.81 percent of Basic.

- Employer gratuity contribution.

- “Statutory benefits (PF, Gratuity, Insurance)”

When you receive this, then you can count on gratuity as part of your CTC.

Example CTC Structure

| Component | Annual (AED) |

|---|---|

| Basic | 13,200 |

| HRA | 5,280 |

| Allowances | 2,640 |

| Employer PF | 1,584 |

| Gratuity | 635 |

| Insurance & Benefits | 422 |

| Total CTC | 26,761 AED |

Read more: Avoid Losing Your UAE Gratuity: 9 Flaws That Trigger Denial

Implications for Take-Home Salary

But now we come to what is really important, the effect of this on what you really receive in hand.

1. Gratuity Does Not Reduce Your Monthly Pay

Gratuity is not deducted, so it does not reduce your monthly take-home. However, when firms promote a CTC that involves gratuity, your real amount in hand would appear lower than the entire package.

2. You Receive Gratuity Completing 5 Years

The qualifications to receive gratuity are that you must have been working with the same company for at least 5 years. You get a lump sum that is calculated in accordance with the last drawn basic salary and years of service when you resign, retire, or are dismissed (without misconduct).

3. It’s a Long-Term Financial Benefit

Gratuity is like a reward on retirement – a thank-you note on the part of your employer to your many years of service. You are not entitled to this benefit when you change jobs more than once within 5 years.

4. Tax Benefits on Gratuity

The best part? The gratuity is tax-free because in the UAE, there is no income tax.

5. Different Rules for Government, Private, and Contract Workers

- Government workers: The gratuity is entirely tax-free, never.

- Contract workers: They are eligible provided they have worked for the same employer within a period of 5 years.

Read more: Don’t Lose Out: Gratuity Guide for UAE Domestic Workers

FAQs

1. How high is the gratuity in CTC?

It is usually 4.81% of base salary.

2. Does it deduct gratuity from my salary?

No. The gratuity is not charged against your pay, but is made by your employer upon your departure after service.

3. Is there any gratuity in case I resign in 3 years?

Yes, you can resign in 3 years, and your company will pay you gratuity.

4. Is it a requirement that all companies have to give gratuities?

Yes, all companies that have 10 or more workers should pay gratuity under the UAE Labor Law.

5. What will become of gratuity in the event of the company closing?

Where the business is closed by your employer, he or she has the legal obligation to pay gratuity to the employees who are employed by the business.

Final Thoughts

You need to know about gratuity and CTC when you wish to control your financial gains and benefits in the long run.

When firms pay gratuity to your CTC, they are merely stating the overall cost of employing you, not subtracting anything from your remuneration.