If you’ve worked diligently and loyally for your company and now the day has come to collect what you’ve rightfully earned, we aren’t talking about stickers here, but gratuity, then you have a proper application to submit for gratuity.

But don’t stress. It is not that difficult to write a gratuity application, it simply needs to be polite, professional and in the format. You are retiring, resigning or you have served 5 years of service continuously; this guide will make you write a letter of gratuity request that is bound to be approved within a short time.

What Is an Application for Gratuity?

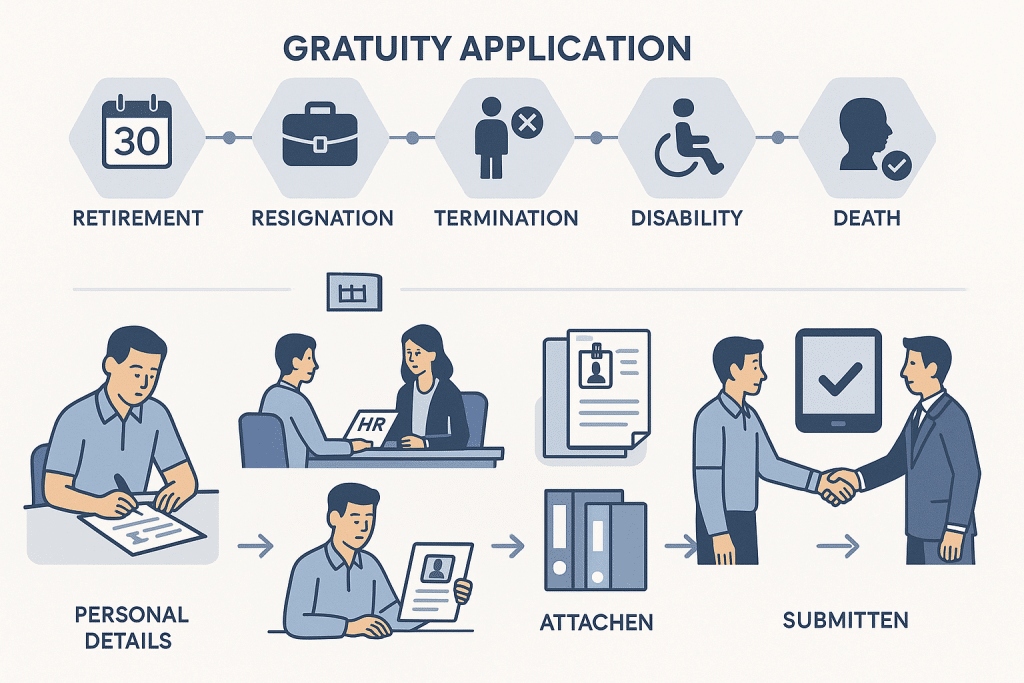

The gratuity application is simply a written application to his employer by the employee requesting granting of gratuity payment on his account upon resignation, retirement or termination.

Federal Decree-Law No. 33 of 2021 provides that in case any employee has served in an organization continuously over five years, he or she is entitled to get gratuity.

When Should You Apply for Gratuity?

You can apply for your gratuity payment at the following cases:

- After retirement or resignation (more than 5+ years of service)

- In case of termination due to closure or down sizing of company

- As a result of permanent disability or health

- Moreover, in case of death, the nominee or legal heir can make an application

Pro Tip: File your application within 30 days of your last working day as a better option for faster processing of application.

How to Write an Application for Gratuity (Step-by-Step Format)

Here’s the correct way to write a professional gratuity application letter that HR can’t ignore:

1. Write Your Personal Details

Start with your name, employee ID, designation, department, and date of joining.

2. Address It Properly

Write to the HR Manager, Finance Department, or Employer — whoever handles employee benefits.

3. Clearly Mention the Purpose

State that you’re applying for payment of gratuity under the Payment of Gratuity Act, 1972.

4. Add Employment Details

Include your joining date, last working day, and total years of service.

5. Attach Required Documents

Attach your resignation letter, relieving letter, ID proof, and bank details.

6. Close Politely

End with a respectful note, showing gratitude for your time in the organization.

Sample Application for Gratuity (Employee to Employer)

To,

The HR Manager,

[Company Name],

[Company Address]

Subject: Application for Payment of Gratuity

Respected Sir/Madam,

I am [Your Name], formerly working as [Your Designation] in your esteemed organization. I joined on [Date of Joining] and served until [Last Working Date], completing [Number of Years] years of continuous service.

As per the Federal Decree-Law No. 33 of 2021, I kindly request the release of my gratuity amount. Please find attached copies of my relieving letter and ID proof for reference.

Kindly process the gratuity payment at the earliest.

Thank you for your consideration.

Yours faithfully,

[Your Name]

Employee ID: [Employee ID]

Contact No.: [Phone Number]

Email: [Email Address]

Email Format for Gratuity Request

If you’re sending the application via email, here’s a short and professional version:

Subject: Request for Release of Gratuity Payment

Dear [HR Manager’s Name],

I hope you’re doing well. I wish to request the release of my gratuity payment under the Federal Decree-Law No. 33 of 2021. I completed [X years] of service with [Company Name] and was relieved on [Date].

Please let me know if you require any documents to process the payment.

Warm regards,

[Your Full Name]

Employee ID: [Employee ID]

Phone: [Number]

Read more: Gratuity & CTC: What % of Salary Gets Deducted?

Documents Required for Gratuity Application

Here’s what you’ll usually need to attach:

- Copy of your resignation/retirement letter

- Relieving letter

- Identity proof (Aadhar, PAN, etc.)

- Bank account details

- Form I (as per the Payment of Gratuity Act)

Frequently Asked Questions

Can I apply for gratuity before resigning?

No. You can only apply for gratuity after your employment officially ends.

How long does it take to get the gratuity amount?

Usually, within 30 days of application submission, delays can incur interest as per the law.

Who is eligible for gratuity?

Employees who have completed five or more years of continuous service under a registered employer.

Is gratuity taxable?

Yes, but it’s partially tax-exempt up to AED 83000 for employees covered under the Act.

Read more: Don’t Lose Out: Gratuity Guide for UAE Domestic Workers

Final Thoughts

Getting your gratuity is more than a piece of paper – it is about taking what you’ve worked for with years of dedication and declaring it yours. A good, well-written application mean that you’ll have your payment processed as fast as possible without endless follow-ups and HR confusion.

If you still are not so sure on how to write that ideal gratuity application letter, do not stress out, we got you covered. Please browse our website for ready-to-use samples, templates, hiring writing tips suggested by the top addiction experts helping save your time and making your letters stick out.